In 2025, the Carrollwood Recreation District is working to replace amenity gate access with digital gate key fobs across White Sands Beach, Scotty Cooper Park, Original Carrollwood Park and the Tennis Courts. Read more for some answers to Frequently Asked Questions regarding the projects.

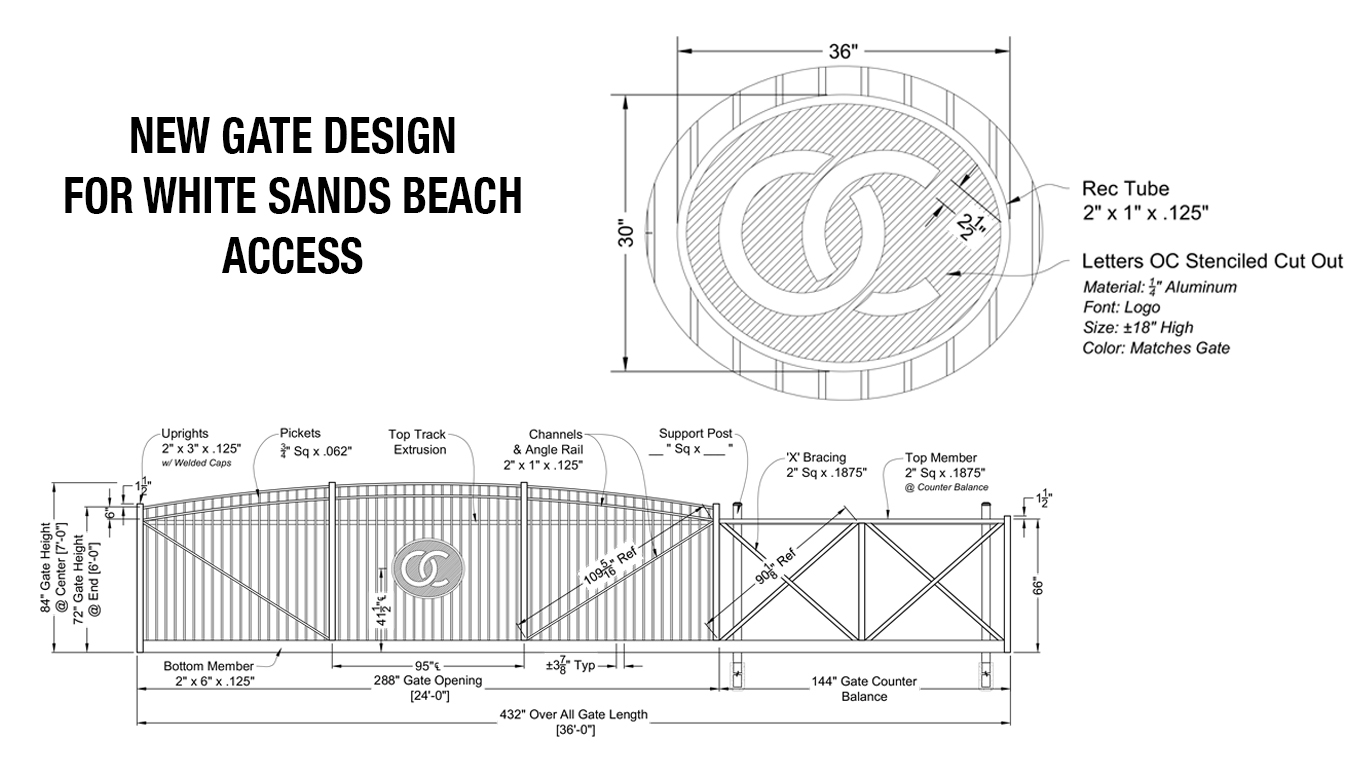

White Sands Beach is the first space for installation of a custom entry and exit gate as well as a pedestrian gate.

Gate and electronic access key fob will happen at White Sands Beach first.

Completion is estimated to be late February to accommodate the busy season beginning during spring break. As new details and plans emerge, the CRD will communicate with residents.

Fobs will cost $30.

It is the CRD’s initial understanding that if someone loses their fob, it can be deactivated. Replacement fobs can be purchased. Ultimately, the cost to the resident will be less than purchasing individual keys for each access point is the system operates now.

The goal is to use the same fob to access all amenities. White Sands Beach, Scotty Cooper Park, Tennis Courts, Original Carrollwood Park, and the dog park.

They can’t be copied at a store, they can be deactivated upon loss, and residents will only need to touch the fob to the sensor to enter and leave.

It is the CRD’s understanding that the fob activation will allow for the programming of those fobs who wish to enter individual amenities. Residents will need approval.

It’s impossible to have every park on the fob system on day one. This is a priority, so we will work to have all spaces active in 2025. There will be a period for transition, so fob and key access will overlap. Whether you have a fob or key, they both serve the same purpose.

The new access points require electricity and cameras. So, there are various considerations at each location. As details and plans emerge, the CRD will let the community know.

No current plans for the boat ramp gate. The boat ramp gate is custom built and only a few years old, and it serves its purpose. White Sands Beach (WSB) is the only community park with vehicle access.

The access control system will be most beneficial when the guard is not present. When the guard is present, the entrance gate will be open.

Purchase from the business office inside the Recreation Center (just like key purchases). We will let you know when we are ready to begin selling them.

As a result of the tax referendum in 2022, funds were allocated for improving the security and aesthetic appeal of neighborhood areas. Reliable and efficient access improvements to parks, beach and tennis courts are planned.

Our community is 66 years-old and the community around our neighborhood has grown significantly. Google searches did not exist until more recently, and many non-residents leave negative and positive reviews about our amenities and facilities.

With the installation of key access to Scotty Cooper Park, for example, access control has proven to be effective and safer.